ABOUT GBC

Welcome to Great Basin College!

Great Basin College values you! Valuing what we have in common and our differences means we will foster a college climate of mutual trust, tolerance, informed discourse and always seek to promote GBC as a "safe space" to explore new ideas and perspectives with opportunities for you to grow, learn and be successful in a friendly, supportive campus environment. GBC enriches people's lives by providing student-centered, post-secondary education to rural Nevada. GBC students enjoy outstanding academic programs, smaller class sizes, and excellent faculty who really care about our students. We are GBC!

ADMISSIONS

ACADEMICS

For High School Students

STUDENT SERVICES

Great Basin College is "The Gold Standard in the Silver State" when it comes to long-distance education and online education delivery. GBC offers hundreds of classes and a diverse array of certificate and degree programs fully online and fully affordable!

COMMUNITY

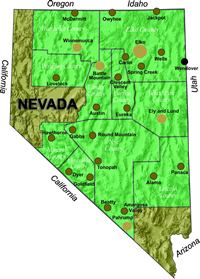

Great Basin College wants to be your choice for higher education. GBC offers associate and baccalaureate level instruction in career and technical education and academic areas. About 4,000 students are enrolled annually online from across the country and on campuses and centers across 86,500 square miles, two time zones, and ten of Nevada's largest counties. We border Arizona, Oregon, Idaho, Utah, and California. We are GBC!

INFORMATION

Need to find COVID-19 information quick? Check out our Coronavirus (COVID-19) Information and Resources page!

RESOURCES

- Financial Home

- Contact

- Consumer Info

- Return of Title IV Funds

- Financial Rights

- Apply for Grants

- Apply for Student Loans

- Apply for a Parent Loan

- Apply for Scholarships

- Nevada Foster Youth Fee Waiver (NSHE)

- Loan Exit Counseling

- Forms Directory

- Cost of Attending

- Financial Aid Handbook

- Gainful Employment

- Satisfactory Progress

- Career Resources

- Student Jobs

FOR MORE INFORMATION

Student Financial Services Office

GBC - Berg Hall

Phone: 775.327.2095

Email: financial-aid@gbcnv.edu

Apply for Federal Direct Student Loans

The Free Application for Federal Student Aid (FAFSA) is the foundation for applying for Federal Direct Student Loans with low interest rates. The interest rate is adjusted every July 1st based on the 91-day T-Bill but will not exceed 8.25%.

In an effort to better educate and provide financial information about your rights and responsibilities as a student loan recipient, Great Basin College is required to have all students complete the Entrance Counseling Session on each loan borrower every academic year.

Upon the completion of the Entrance Counseling and the Master Promissory Note (MPN), GBC will be notified electronically that the student has completed and met the requirements by the Department of Education. Step-by-Step instructions are in the GBC Handbook.

Federal Student Loans are a financial obligation to repay with interest, this decision must be made carefully.

The consequences of not repaying student loans, which can be severe, include the following:

- The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration").

- The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration").

- You can no longer receive deferment or forbearance, and you lose eligibility for other benefits, such as the ability to choose a repayment plan.

- You will lose eligibility for additional federal student aid.

- The default will be reported to credit bureaus, damaging your credit rating and affecting your ability to buy a car or house or to get a credit card.

- Your tax refunds and federal benefit payments may be withheld and applied toward repayment of your defaulted loan (this is called “Treasury offset”).

- Your wages will be garnished. This means your employer may be required to withhold a portion of your pay and send it to your loan holder to repay your defaulted loan.

- Your loan holder can take you to court.

- You may not be able to purchase or sell assets such as real estate.

- You may be charged court costs, collection fees, attorney’s fees, and other costs associated with the collection process.

- It may take years to reestablish a good credit record.

- Your school may withhold your academic transcript until your defaulted student loan is satisfied. The academic transcript is the property of the school, and it is the school's decision - not the U.S. Department of Education’s or your loan holder’s - whether to release the transcript to you.

Reminder: Student Loans do not go away until you repay!

Apply Here

If you are borrowing the subsidized or unsubsidized loan for the first time or a new transfer student to GBC, you will need to complete the (4) mandatory requirements. This is a federal regulation. It will take approx. 20 to 30 minutes to complete.

FAFSA Username and password required to log in.

- Entrance Counseling- This will cover and provide you with valuable information about your rights and responsibilities as a federal student loan borrower. You will be quizzed on your knowledge.

- Master Promissory Note (MPN)- The MPN is a legal and binding document that you promise to repay your student loans and any accrued interest and fees to the U.S. Department of Education. It also explains the terms and conditions of your student loans.

- Completer Annual Student Loan Acknowledgment- Know what you owe! This is a mandatory requirement by the Department of Education before receiving your student loan disbursement.

- Submit Student Loan Request

Are you a Returning GBC Student and had a student loan in 2022-23?

FAFSA Username and password to log in.

- Complete Annual Student Loan Acknowledgment- Know what you owe! This is a mandatory requirement by the Department of Education before receiving your student loan disbursement.

- Submit Student Loan Request

Frequently Asked Questions

What is the difference between the subsidized and the unsubsidized student loans?

Subsidized Loan - Need Based. The government pays the interest accrued on your behalf while you are enrolled half-time. There is a Time Limitation on this loan for first-time borrowers on or after July 1, 2013.

Unsubsidized Loan - Non-Need Based. You are responsible for the accruing interest the day the unsubsidized is disbursed to you.

For all new borrowers who will be receiving a student loan on or after July 1, 2013, a 150% limitation is in effect. The means that a student who is eligible for a subsidized loan will reach their subsidized limit at 150% of a program’s length of study.

- Two Year program- will be eligible for subsidized loan for the equivalent of three (3) years.

- Four Year Program- will be eligible for subsidized loan for the equivalent of six (6) years.

Once a student reaches their 150%-time limitations, their interest subsidy loan limit will end on all outstanding loan that were disbursed after July 1, 2013, and the interest will begin to accrue.

After a student received the Direct Subsidized Loan for their maximum eligibility period, a student is no longer eligible to receive additional subsidized loans. However, a student may continue to receive additional Direct Unsubsidized Loans.

Federal Student Loan Fees - Both the subsidized and unsubsidized loans have an origination fee of 1.057%. For example, your account might show for the semester $1000, but the actual amount posted is $990 because the origination fee was taken out.

Federal Student Loan Interest Rates - As an undergraduate student, the interest rate for both of these loans on after July 1, 2023, but before July 1, 2023 is: 5.50%

Federal Student Loan Limits - How much can I borrow? Determined by student grade level and whether you are dependent or independent student.

Students cannot exceed lifetime borrowing limits. Generally, your outstanding principle balance cannot exceed:

- $31,000 as a dependent undergraduate student (no more than $23,000 of which may be subsidized)

- $57,500 as an independent undergraduate student (no more than $23,000 of which may be subsidized)

Per Federal regulations, for students taking 100% classes online (distance education) and do not live with the GBC Service Area.

Verbiage for the U.S. Department of Education

“Delay disbursement of Title IV funds until the student has participated in the distance education program for a longer and more substantiated period of time (e.g. until an exam has been given, completed, and graded or a paper that has been submitted).

Students wanting a student loan in Spring and Summer semesters must submit progress reports. Some students may have to submit progress reports two times in each semester if:

- 30-day delay: First-time, first-year undergraduate students are subject to a 30-day hold on the disbursement. The 30-day waiting period begins on the first day of the semester. This is a federal regulation.

- Transfer students delay: 100% online classes: If all your classes are all online and you do not live within the GBC Service Area there will be delay.

- Spring and Summer Loans only: must be disbursed in two equal installments within that semester. One half is disbursed at the beginning of semester (if not a 30 day delay) and the second half at the mid-point within that semester. Progress reports will be required for each disbursement. Expect delays!

- Requesting a student loan after October 1st for the fall semester or March 1st for the Spring semester.

- Any financial aid recipient may be subject to submitting progress reports if the SFSO is notified that student has not been attending.

Anticipate Delays!

Students should prepare to purchase books out-of-pocket your financial aid comes through.

When to Request Progress Reports?

This happens when you have completed your first exam (not quizzes) or when you have completed a paper that has been graded, whichever occurs first.

How to Request Progress Reports?

Students will compose an email request for progress reports via WEBCAMPUS (online portal). Every instructor provides each student with a syllabus at the beginning of the semester. The syllabus contains instructor’s contact information, which includes their email address.

Where do instructors send the progress reports?

Instructors must email the progress reports to the financial aid office at: financial-aid@gbcnv.edu.

The Student Financial Services Office Loan Officer will send you an email notifying you that your Student Loan Offer is available for you to accept at MYGBC Student Self-Service Center.

Student Center > Under “Finances”> View and Accept Financial Aid Offer > click on> “2024” > Accept your Student Loan Offer

Reminder! Subsidized is the better one to accept because the government is paying the interest.

Financial Aid disbursement dates: The disbursement date on your Student Center is not the actual date you will receive the refund. This is an internal date (10 days before classes start) that SFSO can start posting funds to pay the Pell Grant, Loans, or Scholarships to pay for classes in August, January, and June.

Refunds are issued the Friday before the semester begins in August, January, and June. Contingent upon meeting the Federal SAP requirements and having a completed financial aid file. Thereafter, refund disbursements will vary for each student.

Tuition and fees, housing, or other GBC institutional charges will be deducted from your financial award and residual will be given to the student by Direct Deposit or a paper Check.

Set up Direct Deposit through MyGBC Student Self Service Center. GBC SFSO is not responsible if a student uses another person’s bank account and does not receive the refund.

Paper Checks: If you do not have Direct Deposit, a check will be generated and mailed to your address listed on the GBC Admission Application. Note: You may encounter problems cashing financial aid checks if you do not have a personal bank account. Most banks require a 7 to 10 business day hold on new accounts. You will not have access to your funds until the check clears.

Federal Satisfactory Academic Progress (SAP) requirements is the term used to signify student's successful completion of course work toward a degree or certificate program. All financial aid students must meet and maintain the Federal SAP standards after each semester to be eligible for their next term of enrollment. These academic standards apply for all periods of enrollment at GBC, regardless of whether or not aid was received.

Federal Regulation require that we monitor the academic progress of all students receiving federal financial aid.

These are the 5 evaluations areas that students must meet after each term:

- Evaluation Area 1:

- Certificate program: 56 credits (complete certificate within this timeframe)

- Associate degree: 90 credits (complete degree within this timeframe)

- Bachelor degree: 180 credits (complete degree within this timeframe)

- Evaluation Area 2:

- 2.0 cumulative gpa

- Evaluation Area 3:

- 2.0 term gpa

- Evaluation Area 4:

- Complete all courses at 100%. This means you must complete all classes you enrolled with letter grades "A thru D".

- Evaluation Area 5:

- Meet the 67% rule. This is calculated by all credits attempted divide by credit completed with letter grades.

Read more about the Federal Satisfactory Academics Progress (SAP) requirements.

Before picking up the phone to call GBC Student Financial Services Office (SFSO), log into your MyGBC Student Service Center to see if there are missing documentations required to complete your financial aid file. If there is no missing documentation and you have read your emails, call the SFS Office.

- GBC Elko is the main campus that processes financial aid for all the GBC Centers for students. No appointment necessary. Students can walk-in or call to get assistance

- GBC has off-campus centers to assist students in Ely, Battle Mountain, Winnemucca, and Pahrump. Students can walk-in or call to get assistance with financial etc.

- MyGBC Student Self-Service Center- We encourage you to check your Student Center often. Your financial aid offer award should be available after May 1, 2023.

- Check your email: GBC will communicate with through email. It is highly recommended that you check your email account regularly. It is recommended that you check your email regularly because there may some important information that may change your financial aid status.

- 3rd-Party: GBC must follow the FERPA Laws. This means that no information regarding a student that includes parents. Students must set up 3rd-party release on file through MyGBC Student Self-Service Center.

- Census Dates: The Student Financial Services Office (SFSO) can only pay for courses enrolled in a week after classes start in August, January, and June. If you enroll classes after that date, SFSO cannot pay for your courses. Call Admissions Office at 775.327.2059 for census dates

- Financial Aid disbursement dates: The disbursement date on your Student Center is not the actual date you will receive the refund. This is an internal date (10 days before classes start) that SFSO can start posting funds to pay the Pell Grant, Loans, or Scholarships to pay for classes in August and January.

- Refunds: are the on Friday’s before classes in August, January, and June. Thereafter, financial aid disbursements will vary for each student.

- Missing Documents: See your To Do List in MyGBC Student Self-Service Center. Missing documentation must be turned in before July 1, 2023 for the fall 2023 term and December 1, 2023 for the Spring 2024 term.

- Direct Deposit: Set up in MyGBC Student Self-Service Center under “Finances”, click on blue link: Enroll in Direct Deposit.

- Federal Student Loan Requests for 2023-24 will be available after July 4, 2023.

- Suspension/Maximum Credit Appeals forms: Must be turned in by August 1st for the Fall term, March 1st for the Spring term, and July 1st for the Summer term. If you missed the deadlines, your appeal will be submitted and reviewed in the next upcoming term listed.

- Set up payment plan: It is recommended for all students including financial aid recipients to set up a payment plan. The GBC Controller’s Office generates the emails with instructions of how to set it up. Call 775.327.2095 for assistance.

- Degree Objective: Federal financial recipients must take courses that are applicable toward the degree objective declared at GBC’s Admission and Records Office. Your financial aid will not pay for those courses that are not applicable toward your degree objective on file at the GBC Admission Office.

- Official Academic Transcripts: Official academics will be required for GBC students select by the U.S. Department of Education after completing the FAFSA if selected for Unusual Enrollment History.

- Progress Reports: will be required for students that have 100% online classes and do not live with the GBC Service Areas. Be prepared for delays and purchasing your book and supplies out pocket until financial aid.

- Family Education Rights and Privacy Act (FERPA): GBC complies with the Family Educational Rights and Privacy Act (FERPA) which is a Federal Law that protects the privacy of student educational records of both current and former students.

Individuals who willfully submit fraudulent information and/or documentation to obtain financial aid funds will be investigated to the fullest extent possible. All cases of fraud and abuse will be reported to the proper authorities. If you purposely give false or misleading information, you may be fined up $20,000, sent to prison, or both.

For More Information Contact

Student Financial Services Office

GBC - Berg Hall

Phone: 775.327.2095

Email: financial-aid@gbcnv.edu

Why Great Basin College

Great Basin College wants to be your choice for higher education. GBC offers associate and baccalaureate level instruction in career and technical education and academic areas. About 4,000 students are enrolled annually online from across the country and on campuses and centers across 86,500 square miles, two time zones, and ten of Nevada's largest counties. We border Arizona, Oregon, Idaho, Utah, and California. We are GBC!