ABOUT GBC

Welcome to Great Basin College!

Great Basin College values you! Valuing what we have in common and our differences means we will foster a college climate of mutual trust, tolerance, informed discourse and always seek to promote GBC as a "safe space" to explore new ideas and perspectives with opportunities for you to grow, learn and be successful in a friendly, supportive campus environment. GBC enriches people's lives by providing student-centered, post-secondary education to rural Nevada. GBC students enjoy outstanding academic programs, smaller class sizes, and excellent faculty who really care about our students. We are GBC!

ADMISSIONS

ACADEMICS

For High School Students

STUDENT SERVICES

As part of Great Basin College's mission of transforming lives through education, GBC offers hundreds of online classes and several certificate and degree programs. See our current catalog for more information.

COMMUNITY

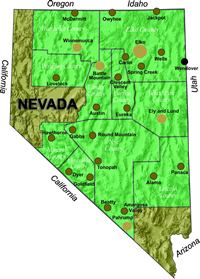

Great Basin College wants to be your choice for higher education. GBC offers associate and baccalaureate level instruction in career and technical education and academic areas. About 4,000 students are enrolled annually online from across the country and on campuses and centers across 86,500 square miles, two time zones, and ten of Nevada's largest counties. We border Arizona, Oregon, Idaho, Utah, and California. We are GBC!

INFORMATION

Need to find COVID-19 information quick? Check out our Coronavirus (COVID-19) Information and Resources page!

RESOURCES

- Financial Home

- Contact

- Consumer Info

- Return of Title IV Funds

- Financial Rights

- Apply for Grants

- Apply for Student Loans

- Apply for a Parent Loan

- Apply for Scholarships

- Nevada Foster Youth Fee Waiver (NSHE)

- Loan Exit Counseling

- Forms Directory

- Cost of Attending

- Financial Aid Handbook

- Gainful Employment

- Satisfactory Progress

- Career Resources

- Student Jobs

- Financial Aid Guide

- Guia para Estudiantes de Primera Generacion

FOR MORE INFORMATION

Student Financial Services

Berg Hall

Great Basin College

Phone: 775.327.2095

Student Loan Exit Counseling

The federal government requires that you complete a student Exit Counseling session prior to graduating, withdraw or drop below half-time status, did not enroll, or placed on financial aid academic suspension. This also includes if you transfer to another school. You will receive a letter or email notification from the GBC Student Financial Services Office if any one of these circumstances occur.

The purpose of the Exit Counseling Session is to help you understand your rights and responsibilities as a student loan borrower. The Exit Counseling explains in detail and goes over a plan to repay, plan for the future, protecting and maintaining your credit score, and the many repayment options available that you are entitled to as a student loan borrower.

Your student loan servicers are there to help you understand your options to find ways to make affordable repayment obligations to avoid defaulting on your student loans.

Reminder- student loans do not go away-unless you repay!

The consequences, which can be severe, include the following:

- The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration").

- You can no longer receive deferment or forbearance, and you lose eligibility for other benefits, such as the ability to choose a repayment plan.

- You will lose eligibility for additional federal student aid.

- The default will be reported to credit bureaus, damaging your credit rating and affecting your ability to buy a car or house or to get a credit card.

- Your tax refunds and federal benefit payments may be withheld and applied toward repayment of your defaulted loan (this is called “Treasury offset”).

- Your wages will be garnished. This means your employer may be required to withhold a portion of your pay and send it to your loan holder to repay your defaulted loan.

- Your loan holder can take you to court.

- You may not be able to purchase or sell assets such as real estate.

- You may be charged court costs, collection fees, attorney’s fees, and other costs associated with the collection process.

- It may take years to reestablish a good credit record.

- Your school may withhold your academic transcript until your defaulted student loan is satisfied. The academic transcript is the property of the school, and it is the school's decision—not the U.S. Department of Education’s or your loan holder’s—whether to release the transcript to you.

How Do I Do It?

Step 1

Sign in at https://studentaid.gov/app/counselingInstructions.action?counselingType=exit to complete the Exit Counseling. This is a federal requirement.

- Student must have a FSA ID Username and Password to access this website. Use the same FSA ID used to electronically the FAFSA..

- Forgot FSA ID? Go to https://fsaid.ed.gov/npas/index.htm.

The Exit Counseling will be electronically sent from the Department of Education to GBC within 72 hours after completion.

Things You Should Know

- Read all email communication from GBC and your Student Loan Servicer.

- You will not receive a paper bill statement from your Student Loan Servicer, only emails.

It will be your responsibility to make your first payment, even if you don’t receive notification from your student loan servicer.

If you are 1 (one) day late in making a payment, you are considered delinquent on your student loan account.

- Avoid Defaulting on your student loans.

- A hold will be placed on your account if you do not complete.

Step 2

Find your loan servicer. Department of Education assigns loan servicer to borrowers. Student Loan borrower receives emails as soon as loan is disbursed (paid out). Loan Service will contact borrower after that. Go to https://studentaid.gov/manage-loans/repayment/servicers

Make Payments

- Click Sign in Now New student > Create One Now

- Follow instructions > Personal Information

- Make interest payments while in school.

- Know what you owe!

Repayment Options

Call your Student Loan Servicer to make arrangements for repayment.

Visit Federal Student Aid website for repayment plans.

- Standard Repayment

- Graduated Repayment

- Extended Repayment

- Income-Based Repayment

- Income-Contingent Repayment

- Pay As you Earn Repayment

- Income-Sensitive Repayment

Cannot afford payments?

You may want to consider:

Call your Student Loan Servicer for more information or questions.

Take Steps to Avoid Default

The worst thing you can do is ignore or not repay your student loans. Understanding your loan agreement, staying on top of your loan information and making sure you contact your loan servicer if you are having trouble making payments to avoid default.

Step 3

Lost track of your student loan documentation?

Sign In: www.nslds.ed.gov to find your Student Loan Servicer.

Student must have a FSA ID Username and Password to access this website. Use the same FSA ID used to electronically the FAFSA.

Forgot FSA ID? Go to https://studentaid.gov/help/forgot-fsa-id

The most important take-away from your Exit Counseling is National Student Loan Database System (NSLDS). This is the U.S. Department of Education’s central database for federal student aid, including federal student loans.

This database will always have up-to-date contact information on your federal aid and student loans.

Student Loan Servicers

Student Loan Servicers are entities paid by the federal government to handle the billing and other services on federal student loans. You do not get to choose your loan servicer – the Department of Education assigns you one.

Financial hardship can happen to anyone. Job loss, medical problems, or unexpected bills can make it difficult to repay your student loans. If you’re a hit with financial hardship, the first step is call your student loan servicer.

Your student loan servicers may be one of the following:

- CornerStone

- FedLoan Servicing (PHEAA)

- Granite State-GSMR

- Great Lakes

- HESC/EDfinancial

- MOHELA

- Navient

- Nelnet

- OSLS Servicing.

Be Aware

Beware of Student Loan Debt Relief Scams! You don’t have to pay for help with your student loans. Student loan servicers are assigned to help you.

Office of the Ombudsman

Help with resolving a problem or dispute with your student loan. If after contacting your student loan servicer and cannot resolve any problems or disputes, you may contact the Federal Student Aid (FSA) Ombudsman for assistance. The FSA Ombudsman works with federal student loan borrowers to resolve disputes or problems from an impartial, independent view. You can reach FSA Ombudsman at:

Office of Ombudsman

U.S. Department of Education

830 First Street NE

4th Floor UCP-#/MS 5144

Washington, DC 20202-5144

Toll-free phone: (877) 557—2575

Internet: fsahelp.ed.gov or ombudsman.ed.gov

Consequences of Defaulting on your federal student loan(s)

Remember, regardless of your situation, you have the responsibility to contact your loan servicer.

The consequences, which can be severe, include the following:

- The entire unpaid balance of your loan and any interest you owe becomes immediately due (this is called "acceleration").

- You can no longer receive deferment or forbearance, and you lose eligibility for other benefits, such as the ability to choose a repayment plan.

- You will lose eligibility for additional federal student aid.

- The default will be reported to credit bureaus, damaging your credit rating and affecting your ability to buy a car or house or to get a credit card.

- Your tax refunds and federal benefit payments may be withheld and applied toward repayment of your defaulted loan (this is called “Treasury offset”).

- Your wages will be garnished. This means your employer may be required to withhold a portion of your pay and send it to your loan holder to repay your defaulted loan.

- Your loan holder can take you to court.

- You may not be able to purchase or sell assets such as real estate.

- You may be charged court costs, collection fees, attorney’s fees, and other costs associated with the collection process.

- It may take years to reestablish a good credit record.

- Your school may withhold your academic transcript until your defaulted student loan is satisfied. The academic transcript is the property of the school, and it is the school's decision—not the U.S. Department of Education’s or your loan holder’s—whether to release the transcript to you.

Don't let this happen to you!

Student Loans never go away - until you repay!

For More Information Contact

Student Financial Services

Berg Hall

Great Basin College

Phone: 775.327.2095

Why Great Basin College

Great Basin College offers associate and baccalaureate level education in academic, career and technical fields. Welcoming students from all corners of the country, both online and at our various campuses and centers, GBC's presence extends across two time zones and spans more than 86,000 square miles throughout Nevada. A leader in rural higher education, GBC takes pride in developing students who are well-prepared to meet the demands of industry and who contribute to the success and prosperity of the local economy.